Hsmb Advisory Llc Things To Know Before You Get This

Hsmb Advisory Llc Things To Know Before You Get This

Blog Article

The Greatest Guide To Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc Can Be Fun For EveryoneThe smart Trick of Hsmb Advisory Llc That Nobody is Discussing7 Simple Techniques For Hsmb Advisory LlcThe Single Strategy To Use For Hsmb Advisory LlcMore About Hsmb Advisory LlcRumored Buzz on Hsmb Advisory LlcIndicators on Hsmb Advisory Llc You Need To Know

Also know that some plans can be expensive, and having specific health and wellness conditions when you use can increase the premiums you're asked to pay. Health Insurance St Petersburg, FL. You will require to see to it that you can pay for the premiums as you will need to commit to making these settlements if you want your life cover to continue to be in positionIf you feel life insurance policy might be helpful for you, our partnership with LifeSearch enables you to get a quote from a number of suppliers in double fast time. There are various sorts of life insurance policy that aim to fulfill various protection requirements, including degree term, reducing term and joint life cover.

See This Report about Hsmb Advisory Llc

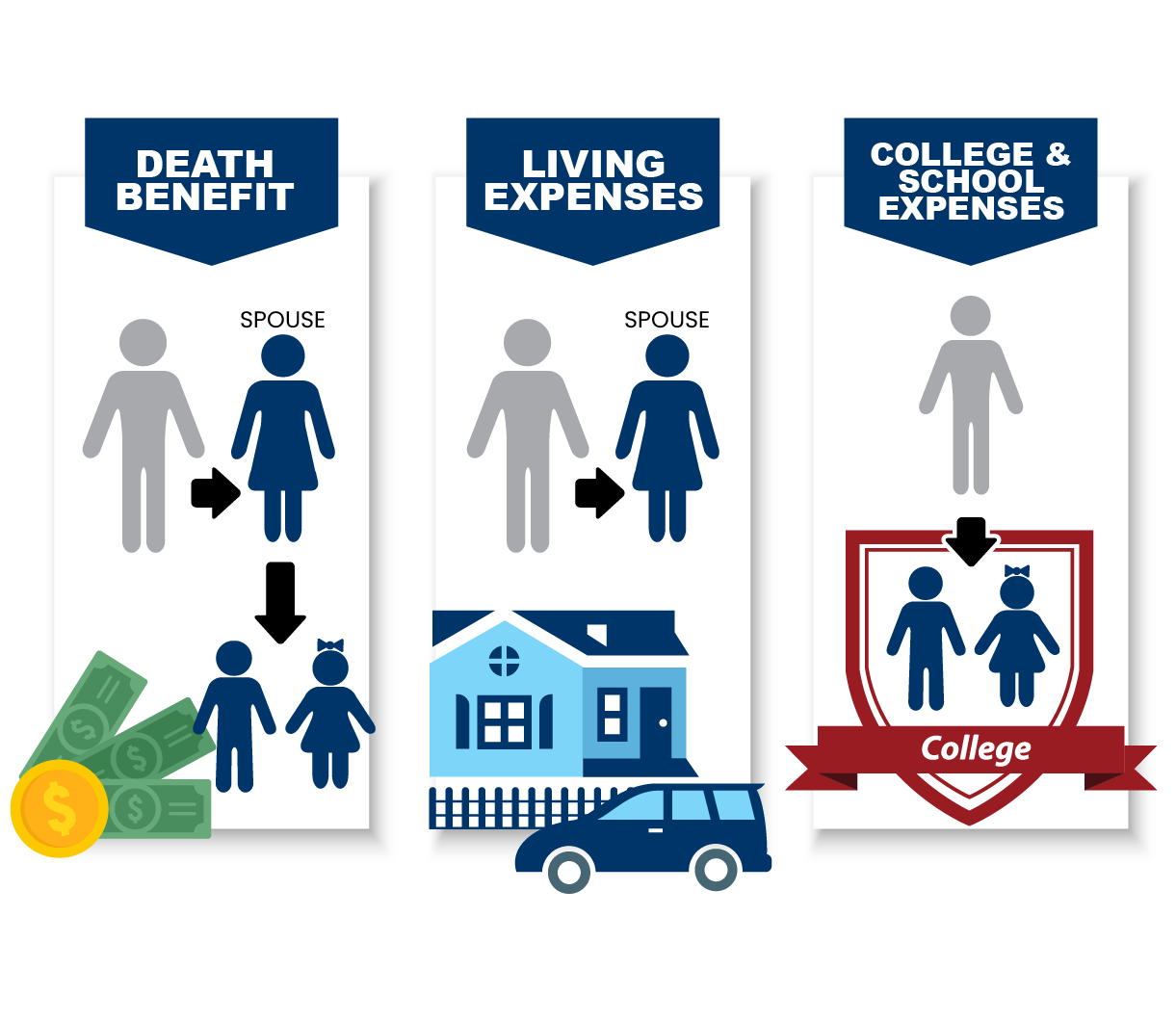

Life insurance provides 5 monetary benefits for you and your family members (Life Insurance). The main benefit of including life insurance policy to your financial plan is that if you die, your heirs get a lump sum, tax-free payment from the policy. They can use this cash to pay your final expenditures and to replace your earnings

Some plans pay if you develop a chronic/terminal ailment and some offer savings you can make use of to support your retired life. In this short article, find out about the numerous advantages of life insurance and why it may be an excellent idea to buy it. Life insurance coverage offers advantages while you're still active and when you die.

Everything about Hsmb Advisory Llc

If you have a policy (or policies) of that size, individuals who rely on your earnings will still have money to cover their ongoing living expenses. Recipients can utilize plan advantages to cover critical everyday expenses like rental fee or home mortgage payments, utility bills, and grocery stores. Ordinary annual expenditures for households in 2022 were $72,967, according to the Bureau of Labor Data.

The Hsmb Advisory Llc Statements

In addition, the money value of entire life insurance coverage expands tax-deferred. As the cash money value constructs up over time, you can utilize it to cover expenses, such as purchasing an automobile or making a down settlement on a home.

If you choose to obtain versus your cash money value, the car loan is exempt to check over here revenue tax as long as the policy is not surrendered. The insurer, however, will certainly charge passion on the car loan quantity until you pay it back (http://www.place123.net/place/hsmb-advisory-llc-saint-petersburg-unite-states). Insurer have varying rates of interest on these finances

See This Report about Hsmb Advisory Llc

8 out of 10 Millennials overestimated the price of life insurance policy in a 2022 study. In reality, the ordinary expense is more detailed to $200 a year. If you assume spending in life insurance policy may be a clever economic relocation for you and your family members, consider seeking advice from a monetary advisor to adopt it into your economic strategy.

The 5 main kinds of life insurance policy are term life, whole life, global life, variable life, and last cost insurance coverage, also known as burial insurance policy. Entire life begins out costing much more, however can last your whole life if you maintain paying the premiums.

Excitement About Hsmb Advisory Llc

It can pay off your financial obligations and clinical costs. Life insurance policy might additionally cover your home loan and supply cash for your household to keep paying their expenses. If you have household depending upon your earnings, you likely require life insurance policy to sustain them after you pass away. Stay-at-home parents and company owner likewise frequently need life insurance.

Essentially, there are 2 sorts of life insurance policy prepares - either term or permanent strategies or some combination of both. Life insurance companies provide various types of term strategies and standard life policies along with "interest sensitive" items which have ended up being extra common since the 1980's.

Term insurance coverage supplies defense for a specific amount of time. This duration can be as brief as one year or supply coverage for a details variety of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance coverage mortality.

What Does Hsmb Advisory Llc Mean?

Currently term insurance coverage prices are really competitive and among the lowest historically knowledgeable. It needs to be noted that it is a widely held idea that term insurance coverage is the least costly pure life insurance policy coverage available. One needs to evaluate the policy terms very carefully to decide which term life options appropriate to meet your particular scenarios.

With each new term the costs is increased. The right to restore the plan without proof of insurability is a vital benefit to you. Otherwise, the danger you take is that your health might wear away and you might be not able to acquire a policy at the very same rates and even in any way, leaving you and your recipients without coverage.

Report this page